News & Press

Proposed Amendments to the NY Cannabis Law

Elana Tamas, the head of cannabis tax at Anchin, wrote this guest column for NY Cannabis Insider in response to the governor’s recent proposed legislation.

Proposed amendments to the New York State cannabis law were undertaken with the implementation of a three-pronged approach of imposing severely consequential provisions to the New York tax, penal and criminal procedure laws.

The changes:

- underscore the efforts that are being undertaken to impede illicit cannabis operations, and to funnel economic activity within the cannabis industry towards the legal market in the state

- ensure that cannabis taxes are paid both on the distributor and retail levels.

While the summary of penalties that can be imposed under the current proposal is somewhat exhaustive, the takeaway is that the strict and punitive provisions within the proposed amendments to the law create accountability and potential to be on the hook for seemingly everyone connected to either an illicit business or a business operating outside of full compliance with procedure regarding the enrollment, filing and remittance/payment of quarterly cannabis taxes.

Failure to comply with the law, or the conduct of business with anyone who would be considered to have illicit cannabis can result in the potential of loss of their own ability to do business, to have severe penalties imposed, and for civil and criminal penalties to be imposed.

The amendments serve to discourage not only licensees and illicit cannabis operators from failure to act within the legal framework, but also particularly provide a framework for penalizing property owners and their agents to create significant risk for them in doing business with illicit operators.

While it remains unclear if any or all the provisions will ultimately become law, the intention can be extrapolated clearly. Accountability for not adhering to state cannabis tax requirements on licensees will jeopardize their ability to operate at a minimum. The intention of deterring the illicit market is already clear, and the takeaway surely is that these efforts will continue to be ramped up.

As a tax professional, my primary concern is to mitigate risk with regard to this specific bill regarding the tax compliance portion. I’ll explain why illicit cannabis tax may not be what most may assume it is, as well as provide insight into why this topic may apply to operators with licenses obtained from the Office of Cannabis Management (OCM), and give a few suggestions on how to ensure to the best extent possible that you are limiting your to exposure to illicit cannabis tax and other penalties.

Under current law, Illicit cannabis is generally defined as a cannabis product on which taxes haven’t been paid. Within the New York Cannabis law, there already is a framework for financial penalties associated with illicit cannabis which is measured by the amount and type of illicit cannabis. While an operator without a license from the OCM will be subject to illicit cannabis penalties because there is no framework for them to pay taxes on legal cannabis, a business owner that fails to pay tax on cannabis renders it as illicit.

The nexus of the determination of illicit cannabis to the payment of cannabis taxes as provided for in the law requires the most careful adherence to compliance with any regulations relating to those payments. The amendments within the legislation seek to cast a wider and deeper net around the hemisphere of culpability associated with lack of compliance with state cannabis tax filings and payment by further tainting an operator’s own cannabis if it is procured from anyone or sold to anyone solely out of compliance with the tax requirements.

While it may end up being that this specific proposal is too Draconian to be passed, it does not mean that changes to the current law are not on the horizon that reflect the objectives of this current proposal, and further, there are ramifications in the current law for failing to register for and pay cannabis taxes already.

The current law for first time offenses already includes the following: Failure for a retailer to register results in a hefty first-time penalty of up to $10,000. Distributors and retailers that do not comply with record keeping requirements are penalized $500 monthly, and if it is determined that you have possessed or sold illicit cannabis (remember the definition is connected to tax payments), your certificate of registration is revoked for a one-year period which would effectively invalidate your ability to operate because you would not be able to pay the cannabis tax, and all of your sales would be related to illicit cannabis.

The actual illicit cannabis penalty depending on various circumstances is at minimum:

- $200 per ounce of illicit cannabis flower

- $5 per milligram of the total weight of any illicit cannabis edible product

- $50 per gram of the total weight of any product containing illicit cannabis concentrate

- $500 per illicit cannabis plant.

The importance of keeping records and invoices for all transactions, and record of payments received and rendered, cannot be underscored enough.

While it is clear that lawmakers’ intention is to penalize noncompliance, to the extent that a missed cannabis tax registration is the only offense, steps could be taken in order to encourage compliance before resorting to punishment.

For example, perhaps a notice should go out to licensees who have not registered or paid their first cannabis tax before determining that a revocation is necessary, or that the cannabis should be subject to the illicit cannabis penalty.

As this bill is written, OCM would have the ability to search a business’ premises and all books and records at any time. The failure to comply results in an automatic suspension of license, and failure to provide invoices from a distributor would lead to treatment of the cannabis as illicit.

My recommendation is to have a general procedure for verifying that retailers and distributors are in compliance with and have procured the proper adult-use cannabis certificate of registration, as well as to ensure that their cannabis license is in good standing before entering into transactions.

Have copies of the support provided to you for your records. I would also have procedures in place that allow for easy access to records for documentation of all transactions, contracts and payments made, received, and remitted when doing business in cannabis.

Have documentation of all transactions relating to items that are not subject to the cannabis tax to be able to readily support that all revenues are not necessarily subject to cannabis tax.

I am partial, but it appears advisors are becoming more and more valuable as the ramifications of non-compliance in the state ramp up. Some general guidelines and resources for compliance and payment of New York cannabis taxes: in addition to receiving a cannabis license from the OCM, a licensee must register with the New York State Tax Department to the extent they would be responsible for paying or remitting cannabis taxes.

Before having control of any cannabis, it is required to have an adult-use cannabis certificate of registration from the State Tax Department for a distributor and retailer (in terms of the licenses that are currently available).

It is also important to note that sales tax registration is a separate requirement for any operator that will be selling non-cannabis products, and requires a separate registration from the cannabis tax registration.

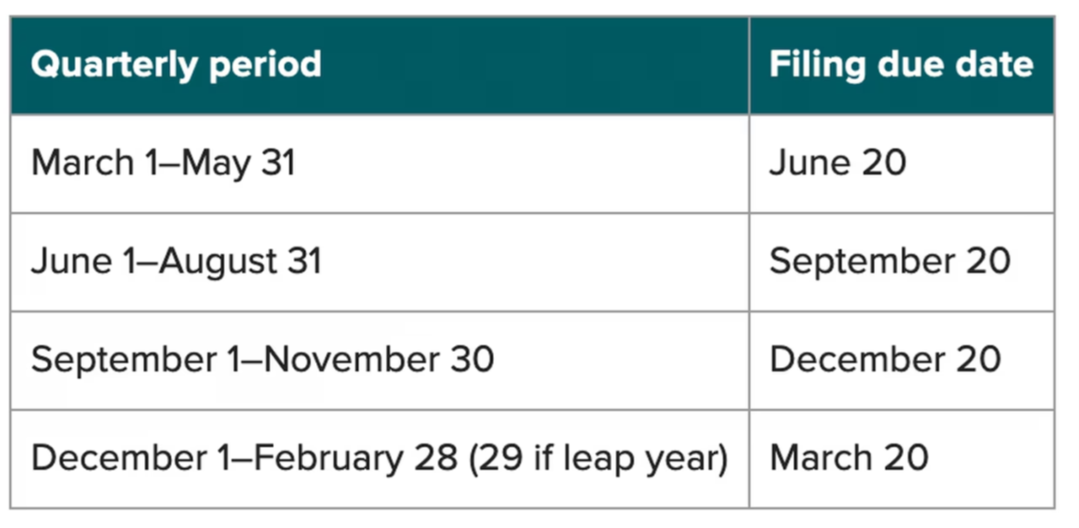

Both distributors and retailers are responsible for submitting quarterly returns which document the calculation of cannabis taxes imposed. Filings and payments are made on a quarterly basis according to the schedule provided below.

The New York State Taxing Authority website provides guidance on how to register, file quarterly tax returns for cannabis tax as follows: