Articles & Alerts

Key Takeaways: Estate and Gift Planning Benefits for Multi-Generational Families with Real Estate

Anchin’s Real Estate and Private Client Groups hosted an event to inform real estate owners about the importance of reviewing their estate and gift plan options before the increased federal lifetime gift tax exemption amount, which is currently $13.61 million per single taxpayer, expires at the end of 2025. The discussion was led by Mark Schneider, Partner and Tax Leader of Anchin’s Real Estate Group; Tamir Dardashtian, Tax Principal in Anchin’s Private Client Group; and Christopher C. Gerard, Chair of the Wills, Trusts, and Estates Group at Anderson Kill.

The panelists discussed current market conditions, including low property values and high interest rates, highlighting the strategic opportunities these present for wealth transfer. They also examined various planning tools to help maximize estate planning benefits. With the federal estate tax exemption set to drop by an estimated 50 percent or more after December 31, 2025, now is an optimal time for estate planning.

Some key points shared by the esteemed panelists include:

Planning is Essential

- Understand your family’s goals: There are several options that are available to individuals developing their estate and gifting strategy. The panel emphasized the importance of understanding each family member’s goals, including whether they prefer to witness the impact of their planning during their lifetime or prefer to have arrangements that take effect post-mortem. There is no single method for transferring wealth before the exemption expires, as each plan needs to be tailored to the needs and wants of the individuals and families. It’s crucial to discuss options with the appropriate family or business members before preparing documents. Professionals are available to offer guidance and ensure that tax and other strategies are implemented in an optimal way.

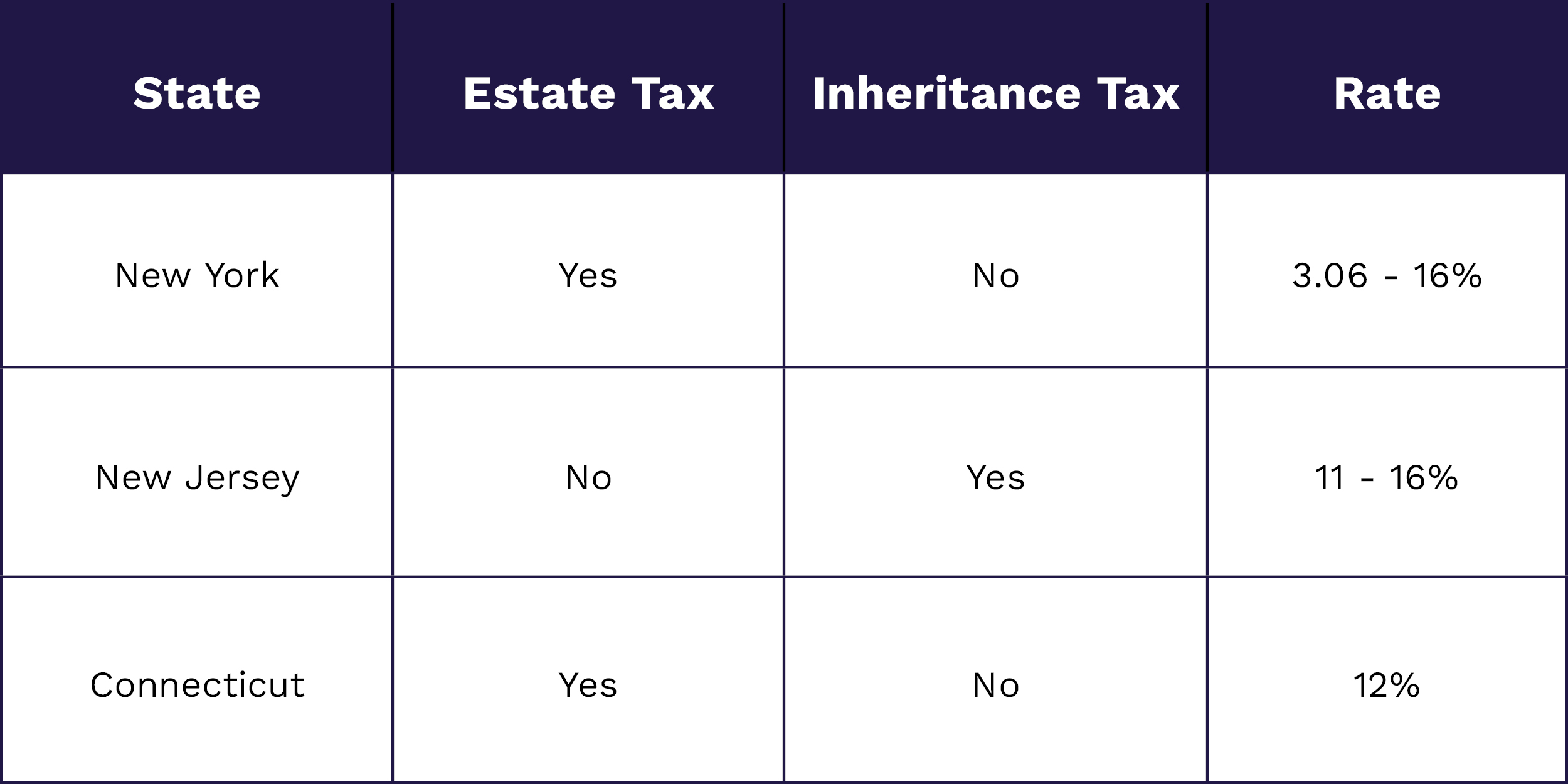

- State-Specific Estate Tax Considerations: It’s important to consider both federal and state-specific tax implications. For example, New York imposes a top estate tax rate of 16%, New Jersey has an inheritance tax but no estate tax, and Connecticut imposes a 12% tax rate. Therefore, if this planning opportunity is missed, families could face significant additional tax burdens as they transfer wealth, depending on the state tax laws that will apply to them.

- Political Uncertainty: The anticipated reduction in the federal estate tax exemption introduces a level of uncertainty due to the upcoming election. While the current trend suggests a likely reduction due to fiscal needs, future political shifts could alter this trajectory. Planning for both scenarios will ensure effective estate planning regardless of the future developments.

Estate Planning Valuations And Tax Saving Methods

- Life Insurance: Insurance as a crucial component of estate planning, providing liquidity to pay taxes and equalize family business interests. The portability of the unused exemption from the death of the first spouse to the surviving spouse is a key aspect, although New York does not offer portability.

- Section 6166: This allows an estate executor to defer the payment of federal estate tax attributable to the interest in a closely held business, extending payments over an extended period of time not to exceed fourteen years and nine months.

- Gifting Strategies: Substantial gifting is an opportunity to fully benefit from the current exemption, with options including outright gifting, irrevocable trusts, Spousal Lifetime Access Trusts (SLATs), and Dynasty Trusts. These strategies help move wealth outside of the taxable estate and provide privacy, creditor protection, and potential multi-generational benefits.

Types of Trusts

- Revocable Trusts: These lifetime trusts are part of the grantor’s estate and can be modified. They help avoid probate and provide privacy but are not considered completed gifts.

- Irrevocable Trusts: These trusts are not part of the grantor’s estate and cannot be changed once set. Assets in irrevocable trusts are considered completed gifts, allowing individuals to move wealth outside their taxable estate and avoid estate taxes.

Ensuring that agreements align with estate planning documents can prevent significant tax consequences. It’s never too early to start planning for the future. The earlier insurance policies, trusts and other planning vehicles are established, the more value they can provide. A well-crafted roadmap can greatly influence tax and financial outcomes.

The combination of the upcoming estate tax exemption sunset, low valuations, and high interest rates makes now an ideal time for estate planning. For more information on how to leverage the federal exemption before it expires at the end of 2025, please contact Mark Schneider, Tamir Dardashtian, or your Anchin Relationship Partner.

Watch the full recording below:

DISCLAIMER: The material and information included in this presentation have been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. Before making any decision or taking any action, you should consult a professional advisor who has been provided with all pertinent facts relevant to your particular situation.