Articles & Alerts

Understanding U.S. Tax Residency Rules: A Guide for Foreign Companies Holding Assets in U.S. Partnerships

Many foreign individuals and companies strategically utilize the United States as a jurisdiction for holding assets as a form of asset protection planning. This inbound international tax planning strategy can range from investing in U.S. partnerships to cases with no active operations beyond maintaining a bank account. With the increasing popularity of this approach comes a greater need for foreign companies to better understand U.S. tax residency rules for effective planning and compliance. Companies utilizing this strategy must be aware of the nuances of the rules associated with partnerships involving foreign owners and operations for it to be effective.

Distinction Between Organization and Residency

Understanding the distinction between where a partnership is organized and where it has residency is crucial for foreign partners in U.S. partnerships in order to determine whether the entity is domestic or foreign and what are its U.S. tax obligations.

- Partnership Organization refers to the jurisdiction under which a partnership is legally formed. This is typically where the partnership files its formation documents and dictates where tax filings may be necessary based on the entity’s formation under specific jurisdictional laws. For U.S. partnerships, the state of organization determines certain legal aspects of the partnership’s existence, including the rules governing its operations and dissolution.

- Partnership Residency relates to where the partnership conducts its business activities and is often tied to the location of its operations and management. A partnership’s residency can impact its tax obligations and its classification under U.S. tax law. This affects how income is treated and determines where taxes are payable.

According to Internal Revenue Service (IRS) regulations, an entity (including a partnership) is recognized domestically if it is created or organized within the United States. Conversely, partnerships formed in foreign jurisdictions are considered foreign entities.

Effectively Connected Income

A critical factor in determining the residency of partnerships is whether the partnership has an active trade or business in the U.S. If a partnership or its employees perform services in the U.S., it may be considered engaged in an active U.S. trade or business and thus have effectively connected income (ECI), that is subject to U.S. tax. Without an active U.S. trade or business, a partnership does not have effectively connected U.S. income (ECI) and may or may not be subject to U.S. tax obligations.

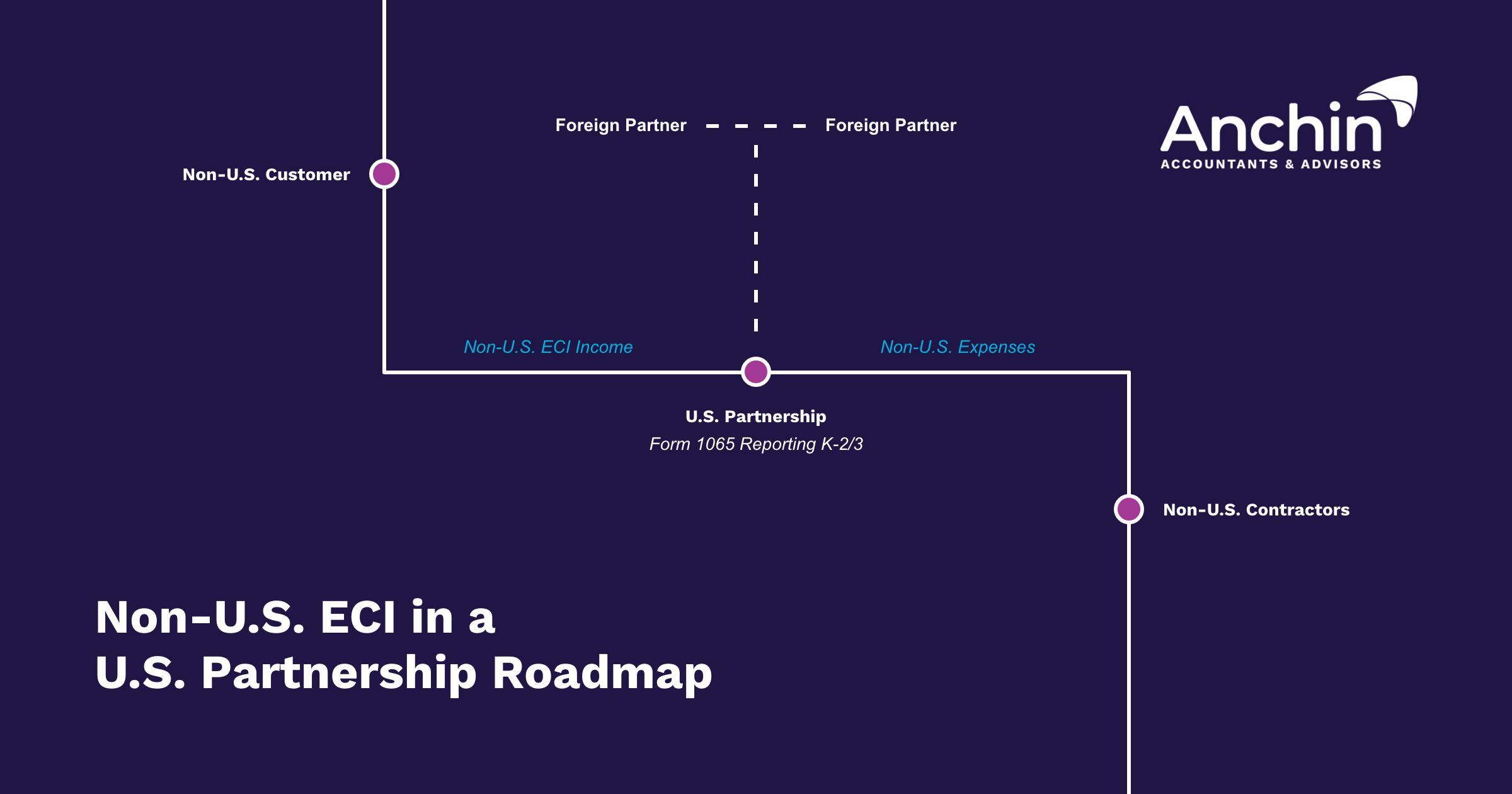

Consider a foreign trade or business filing a U.S. partnership return. Despite potentially having a U.S. tax return filing requirement, if the business only has a U.S. operating bank account, has only contractors but no employees, and all business activities are located outside the U.S., the business would neither be considered a U.S. resident nor have an active US trade or business, resulting in non-U.S. ECI (see chart below).

However, this does not preclude the possibility of U.S. taxable income. For instance, a U.S. partnership that owns an operating bank account with all its business conducted outside the U.S. could still face U.S. withholding tax if foreign partners receive accrued interest payments from accounts operated at the U.S. partnership level.

Conclusion

Residency determination and planning are vital for foreign investors seeking to limit their U.S. filing obligations and exposure to U.S. taxable income. Strategic planning is increasingly being utilized by foreign investors to safeguard assets from their local jurisdictions.

To learn more about the U.S. partnership residency rules and the importance of utilizing them carefully in order to benefit your business, please reach out to Gwayne Lai or Kevin Brown from Anchin’s International Tax Group, or your Anchin Relationship Partner.