Articles & Alerts

Additional Relief: Federal Reserve Releases Additional Guidance on $600 Billion Main Street Lending Program

On Thursday, April 30, 2020, the Treasury Department and the Federal Reserve (the “Fed”) released updated guidance on the Main Street Lending Program, which is comprised of the Main Street Expanded Loan Facility (the “Expanded Loan” or “MSELF”), the Main Street New Loan Facility (the “New Loan” or “MSNLF), and a newly added third option, the Main Street Priority Loan Facility (the “Priority Loan” or “MSPLF”). Together, these three facilities comprise $600 billion of funding for loans to small and mid-sized companies on favorable terms in order to provide additional COVID-19-related financial relief.

The availability of additional credit is intended to help companies that were in sound financial condition prior to the onset of the COVID-19 pandemic to maintain their operations and payroll until conditions normalize. The Main Street Lending Program should provide much-needed liquidity to businesses by having a special purpose vehicle (“SPV”) created by the Fed to purchase 85% (for the MSPLF) or 95% (for the MSELF or MSNLF) of each loan from Eligible Lenders (or “Lenders”) made under this program through September 30, 2020. The Fed noted that a start date for the program will be announced soon.

For all three Main Street loans, an Eligible Borrower (or “Borrower”) is a businesses that (i) was established prior to March 13, 2020; (ii) is not an ineligible business [1]; (iii) has up to 15,000 employees or $5.0 billion or less in 2019 annual revenue, including Affiliates (the original guidance was capped at 10,000 employees and less than $2.5 billion in revenue); (iv) was created or organized in, or under the laws of, the United States, with significant operations in and a majority of their employees based in the United States; (v) does not participate in one of the other two Main Street lending programs or the Primary Market Corporate Credit Facility; and (vi) has not received specific support pursuant to Section 4003(b)(1)-(3) of the CARES Act (i.e., loans to passenger and cargo air carriers or businesses that maintain national security).

Businesses that have taken advantage of the PPP loans may also utilize Main Street Lending Program loans. However, unlike a PPP loan, loans under this program are not forgivable.

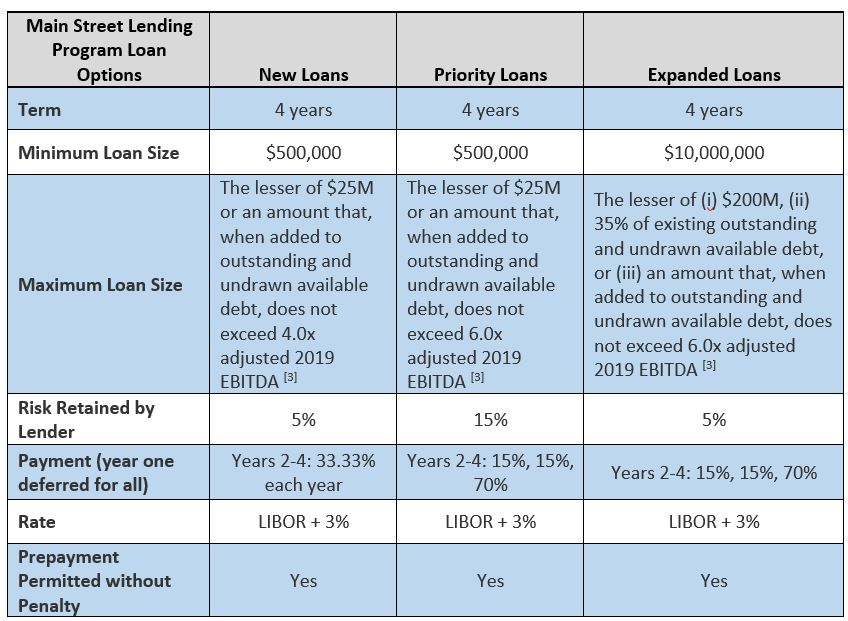

Lenders may (i) originate a New Main Street Loan or Main Street Priority Loan after April 24, 2020, or (ii) expand (or upsize) an existing Main Street Loan that was originated on or before April 24, 2020 and that has a remaining maturity of at least 18 months. Loans under this program will generally have the following terms [2] :

The Federal Reserve recognizes that the credit risk of asset-based Borrowers, as a matter of practice, is generally not evaluated on the basis of EBITDA. The Federal Reserve and the Treasury Department will be evaluating the feasibility of adjusting the loan eligibility metrics of the Program for such Borrowers.

Other guidance for all three loan programs is as follows:

Collateral Requirements: MSNLF loan, MSPLF Loans, and MSELF Upsized tranches may be either secured or unsecured by collateral. An MSELF Upsized Tranche must be secured if the underlying loan is secured.

Loan Classification: If the Borrower (New or Priority Loans) had other loans outstanding with the Lender as of December 31, 2019, or has an existing loan to be expanded (Expanded Loan), such Loan must have had an internal risk rating equivalent to a “pass” in the Federal Financial Institutions Examination Council’s supervisory rating systems of December 31, 2019.

Assessment of Financial Condition: Lenders are expected to conduct an assessment of each potential Borrower’s financial condition at the time of the potential Borrower’s application.

Required Borrower Certifications and Covenants:

Lenders will require the following attestations from Borrowers:

The Borrower must commit to refrain from repaying the principal of, or paying any interest on, any debt until (i) the Eligible Loan (for Priority or New Loans) or (ii) the upsized tranche of the Eligible Loan (for Expanded Loan) is repaid in full, unless the debt or interest payment is mandatory and due.

The Borrower must commit that it will not seek to cancel or reduce any of its committed lines of credit with the Lender or any other lender.

The Borrower must certify that it has reasonable basis to believe that, as of the date of the (i) origination of the Eligible Loan (for New Loans or Priority Loans) or (ii) upsizing of the Eligible Loan (for Expanded Loans) and after giving effect to such loan or upsizing, it has the ability to meet its financial obligations for at least the next 90 days and does not expect to file for bankruptcy during that time period.

The Borrower must commit that it will follow compensation, stock repurchase, and capital distribution restrictions that apply to direct loan programs under section 4003(c)(3)(A)(ii) of the CARES Act, except that an S corporation or other tax pass-through entity (such as an LLC) may make distributions to the extent reasonably required to cover its owners’ tax obligations in respect of the entity’s earnings.

These restrictions include that Borrowers may not pay dividends on common stock for the duration of the loan plus one year. In addition, for the duration of the loan plus one year thereafter, the Borrower must agree to the following (See Section 4004 of the CARES Act):

- for any non-union employee or officer whose 2019 total compensation exceeded $425,000, total compensation for any 12-month period may not exceed 2019 total compensation levels;

- for any employee or officer whose 2019 total compensation exceeded $3.0 million, total compensation for any 12-month period may not exceed the sum of (i) $3.0 million plus (ii) 50 percent of the excess over $3.0 million of compensation received during 2019;

- for any person in either of the above categories, severance upon termination may not exceed two times the 2019 maximum total compensation.

Retaining Employees: Each Borrower that takes a loan should make commercially reasonable efforts to maintain its payroll and retain its employees during the time the loan or upsized tranche of the loan is outstanding.

Transaction Fee: A Lender will pay the SPV a transaction fee of (i) 100 basis points of the principal amount of a New Loan or Priority Loan, or (ii) 75 basis points of the upsized tranche of an Expanded Loan. The Lender may require the Borrower to pay this fee.

Loan Origination/Upsizing and Servicing Fees: A Borrower will pay a Lender an origination fee of up to (i) 100 basis points of the principal of the loan for a New Loan or Priority Loan, or (ii) 75 basis points of the principal amount of the upsized tranche of the loan for an Expanded Loan.

Applying for a Main Street Loan

To obtain a loan under the Program, a Borrower must submit an application and any other documentation required by a Lender. Borrowers should contact a Lender for more information on whether the Lender plans to participate in the Program and to request more information on the application process.

Borrowers do not automatically qualify for a loan under this program. Lenders are expected to conduct an assessment of each potential Borrower’s financial condition at the time of the potential Borrower’s application and will apply their own underwriting standards in evaluating the financial condition and creditworthiness of a potential Borrower. Lenders may require additional information and documentation in making this evaluation and will ultimately determine whether a Borrower is approved for a Program loan in light of these considerations. Businesses that otherwise meet the requirements may not be approved for a loan or may not receive the maximum allowable amount.

Details for the Main Street Lending programs from the Fed can be found at this link:

https://www.federalreserve.gov/monetarypolicy/mainstreetlending.htm

These programs provide an additional source of financial support for qualifying businesses. For more information on these programs, please contact your Anchin relationship partner, or contact our COVID-19 Resource Team at [email protected].

Disclaimer: Please note this is based on the information that is currently available and is subject to change.

[1] An ineligible Business is a type of business as listed in 13 CFR 120.110(b)-j) and (m)-(s) and as modified by regulations implementing the PPP established by Section 1102 of the CARES Act. This includes financial businesses engaged in lending such as banks, finance companies and factors, passive businesses owned by developers and landlords, life insurance companies, and others. See https://www.law.cornell.edu/cfr/text/13/120.110

[2] Source to the Chart: https://www.federalreserve.gov/newsevents/pressreleases/monetary20200430a.htm

[3] EBITDA is defined as Earnings before Interest Taxes, Depreciation and Amortization.