News & Press

Interest expense is going up. Your taxes might be too.

By Kevin McHale, CPA

The rising interest rates will directly affect real estate businesses operating across all asset classes. The ability to deduct interest expense for tax purposes has helped to alleviate some of the tax burden for business owners. However, the Tax Cuts and Jobs Act of 2017 (“TCJA”) imposed limitations on the deductibility of interest expense for certain taxpayers. For tax years beginning on or after January 1, 2022, some of the adjustments that increased the allowable deduction of interest expense for certain taxpayers have sunset. Accordingly, the sun-setting of these provisions may result in significant increases in taxable income for leveraged businesses subject to these rules. Understanding how the changes to the rules may impact your business now will enable you to properly manage your business’s cash flow and avoid any tax surprises next April.

The rising interest rates will directly affect real estate businesses operating across all asset classes. The ability to deduct interest expense for tax purposes has helped to alleviate some of the tax burden for business owners. However, the Tax Cuts and Jobs Act of 2017 (“TCJA”) imposed limitations on the deductibility of interest expense for certain taxpayers. For tax years beginning on or after January 1, 2022, some of the adjustments that increased the allowable deduction of interest expense for certain taxpayers have sunset. Accordingly, the sun-setting of these provisions may result in significant increases in taxable income for leveraged businesses subject to these rules. Understanding how the changes to the rules may impact your business now will enable you to properly manage your business’s cash flow and avoid any tax surprises next April.

History

Prior to the TCJA, taxpayers were generally able to deduct their business interest expense in its entirety. The TCJA imposed limitations on the deductibility of business interest expense for taxpayers that met the following:

- Gross receipts exceed certain thresholds ($27 million for tax year 2022, adjusted for inflation, and subject to aggregation among commonly owned entities); or

- Deemed tax shelters due to loss allocations (more than 35% of taxable losses are allocated to limited partners or limited entrepreneurs).

For affected taxpayers, interest expense is limited to the sum of: (a) business interest income, (b) 30% of adjusted taxable income (defined below), and (c) floor plan financing interest. For this purpose, business interest income is income earned by a trade or business, meaning investment interest does not qualify. Floor financing plan interest is generally interest paid by automobile dealerships on inventory.

Any interest not deductible from an activity in the current year can be carried forward and utilized in a future tax year. If the activity produces sufficient income or is disposed of in a subsequent tax year, the taxpayer can either deduct or adjust their tax basis with the previously suspended interest.

Adjusted Taxable Income

As mentioned above, one of the limitations for deducting interest expense is the 30% of adjusted taxable income (ATI) limitation. The starting point in calculating a taxpayer’s ATI is taxable income before application of the interest expense limitation. For tax years beginning before January 1, 2022, certain items such as business interest expense, depreciation, amortization, net operating losses, and any deduction or loss not associated with a trade or business were added back to arrive at taxable income. Other items such as business interest income and non-trade or business income reduced ATI. But for tax years beginning on or after January 1, 2022, the addbacks for depreciation and amortization will no longer be permitted when calculating ATI. For many real estate businesses, this will lead to a significant reduction in ATI, which will further limit the deductibility of interest expense.

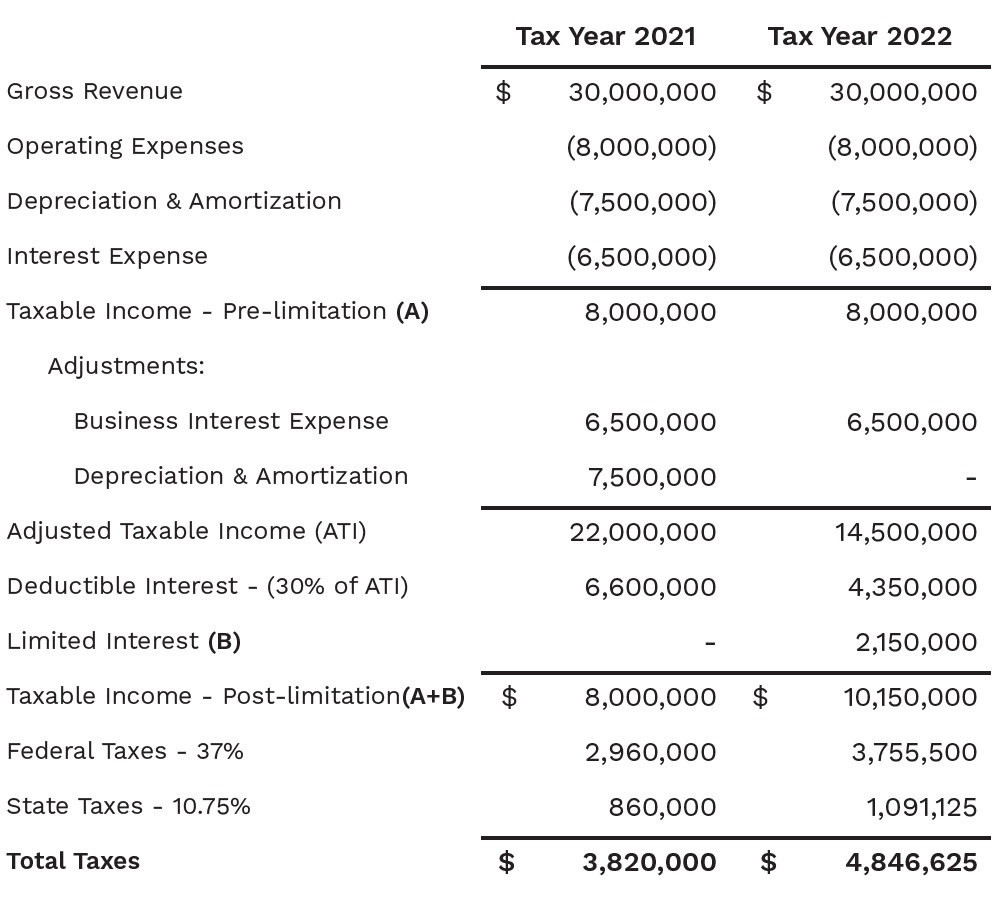

Provided below is an example that highlights how taxable income will be affected by the sun-setting of these provisions using an average 37% federal tax return and hypothetical 10.75% state tax rate.

Considerations & Planning

One potential option available to many real estate businesses to mitigate the effects of the law change and continue to avail themselves to the “full” interest expense deduction is to irrevocably elect out of the interest limitation rules.

However, the trade off to making this election is longer depreciable lives for real property. Under the opt out, a residential property’s depreciable life is extended from 27.5 years to 30 years and a nonresidential property’s depreciable life is adjusted from 39 to 40 years. In addition, for owners of nonresidential real estate, the election disallows 100% bonus depreciation on certain building improvements placed in service during the year. Owners planning major build outs will need to weigh the cost of losing accelerated depreciation against potential interest limitations. Unfortunately, this analysis will become even more challenging in the future since starting with tax years beginning in 2023, the availability of bonus depreciation on qualifying property placed in service drops 20% each year (80% of property placed in service for 2023, 60% for 2024, and so on) until it is completely phased out in tax year 2027.

It is more important now than ever for businesses to plan for the future as the sun-setting of several TCJA provisions can produce substantially different tax results for identical sets of facts in given years. The loss of depreciation and amortization adjustments while calculating adjusted taxable income can have a significant negative impact on the deductibility of interest expense. Businesses and business owners that do not plan accordingly may have unforeseen stresses on cash flow due to larger than anticipated tax liabilities.