Articles & Alerts

Federal Reserve Releases Further Guidance on $600 Billion Main Street Lending Program

On May 27, 2020, the Federal Reserve Bank of Boston released FAQs and form documents for the Main Street Lending Program, signaling that loans under this program will be made available soon.

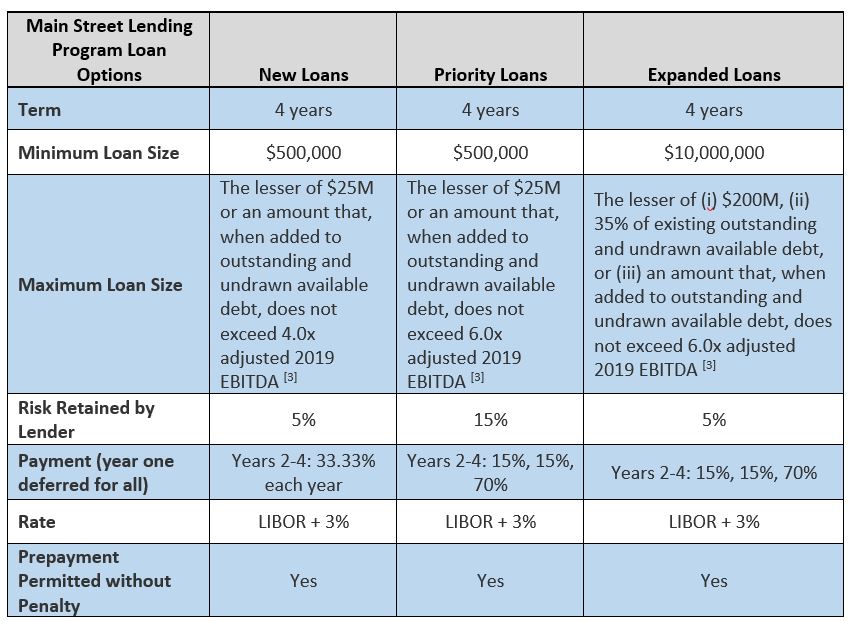

The Main Street Lending Program is comprised of the Main Street Expanded Loan Facility (the “Expanded Loan” or “MSELF”), the Main Street New Loan Facility (the “New Loan” or “MSNLF), and the Main Street Priority Loan Facility (the “Priority Loan” or “MSPLF”). Eligibility criteria are the same across all of the loan facilities and are detailed in our prior Anchin Alert on the Main Street Lending Program. The FAQs clarify that while private equity funds are not eligible to borrow under this program, portfolio companies may qualify, provided they meet the size requirements after applying the relevant Affiliation rules (the same as those under SBA programs like PPP). Businesses that received a PPP loan may also be eligible for a loan under the Main Street Lending Program provided they meet the Eligible Borrower (“Borrower”) criteria (the same industry restrictions as under SBA programs, unless modified by the Federal Reserve). Keep in mind, unlike the PPP loans, Main Street Loans are full-recourse loans and are not forgivable.

As previously reported, each of these loan facilities has a maximum loan amount of the lesser of $25 million in the case of the MSNLF or MSPLF, or $200 million in the case of the MSELF, or an amount that, when added to the Borrower’s existing outstanding and undrawn available debt, does not exceed 4 times EBITDA in the case of the MSNLF or 6 times EBITDA in the case of the MSPLF or MSELF. [1]

In the prior guidance issued for Main Street Loans regarding EBITDA, in the case of an MSELF loan, EBITDA must be determined utilizing the same methodology the lender previously required in extending credit to the Borrower. For new Borrowers or existing Borrowers with EBITDA that was not calculated in determining their prior loan amount, lenders must utilize a methodology the Lender has used prior to April 24, 2020 for extending credit to similarly-situated Borrowers. The newly issued FAQs clarify how EBITDA will be determined in certain circumstances. If an Eligible Lender (“Lender”) has used multiple EBIDTA adjustment methods with respect to the Borrower or (when applicable) similarly-situated Borrowers, the Lender must use the most conservative method it has previously employed. Lenders may not “cherry pick” or apply EBITDA adjustments used by the lender at different points in time or for a range of purposes. The Lender should document the rationale for its selection of an adjusted EBITDA methodology.

To obtain a loan under this program, a Borrower must submit an application and other documentation required by a Lender to such Lender. Interested Borrowers should contact their Lender to determine whether that Lender is participating in the Main Street Loan program. Borrowers will have to meet both the eligibility criteria and the underwriting criteria of the Lender they are working with.

More details for the Main Street Lending Program can be found here: https://www.bostonfed.org/supervision-and-regulation/supervision/special-facilities/main-street-lending-program.aspx

The Main Street Lending Program facilities provide additional sources of financial support for qualifying businesses. For more information on these programs, please contact your Anchin Relationship Partner, or contact our COVID-19 Resource Team at [email protected].

Disclaimer: Please note this is based on the information that is currently available and is subject to change.

[1] The MSELF calculation of maximum loan size also compares the above mentioned amounts to the lesser of 35% of the Borrower’s existing outstanding and undrawn debt that is pari passu in priority with the MSELF Upsized Tranche and equivalent in secured status.