Articles & Alerts

Grantor Retained Annuity Trusts (GRATs), a Proven Estate Planning Strategy

As we approach year end, many are capitalizing on today’s low interest rates and values using estate planning techniques that may be unavailable under a new U.S. administration. Setting up a Grantor Retained Annuity Trust (GRAT) is a proven and regulated approach that should be considered before it is too late.

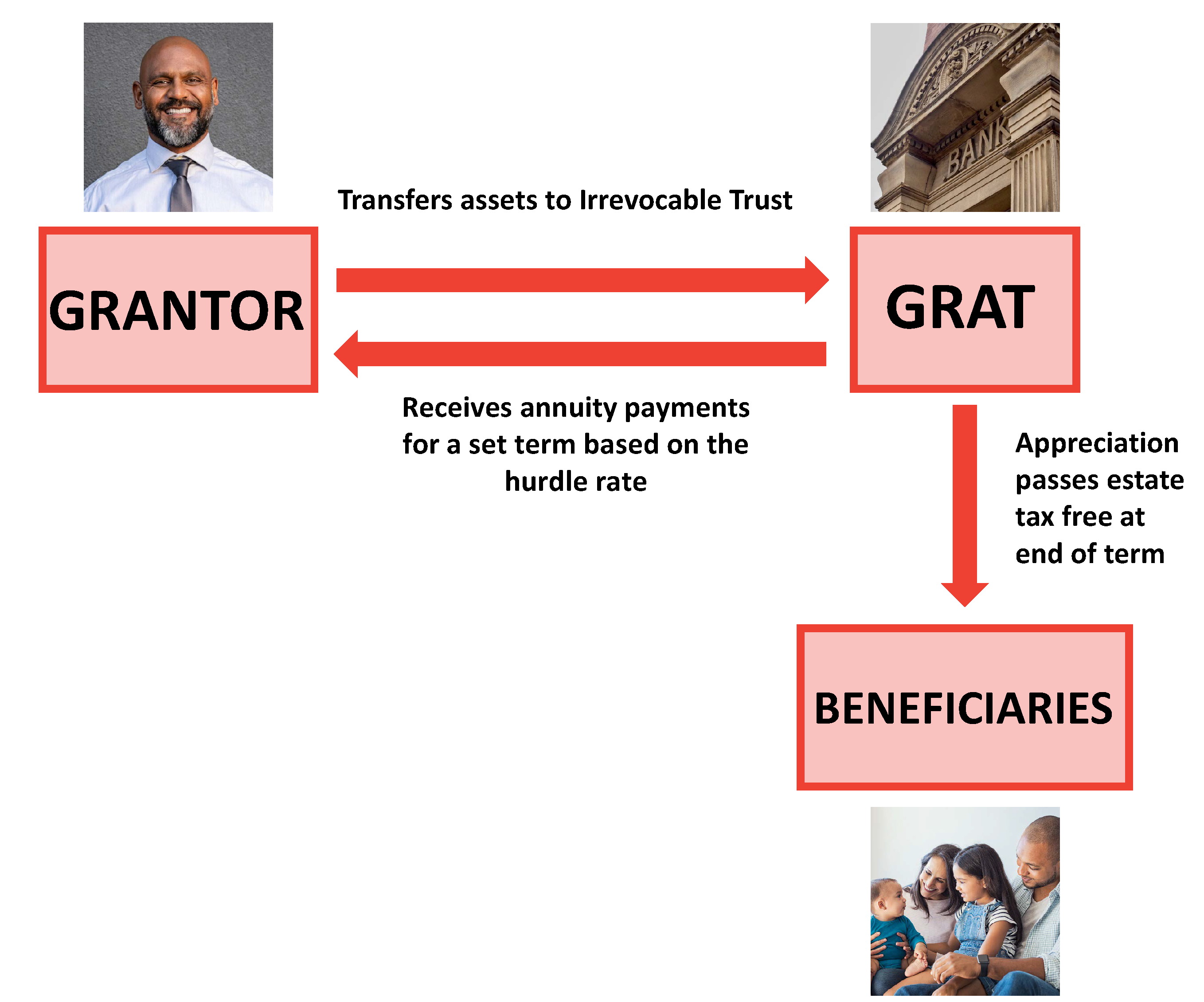

A GRAT is an irrevocable trust into which an individual (the grantor) can transfer an asset and receive an in kind annual payment (annuity) for a specified period of time (GRAT term). These trusts are unique in that they can be designed to not utilize gift tax exemptions, vary annuity payments so that the first payment is lower to give an asset more growth capability, and include the right to swap the trust asset to lock in appreciation for future heirs with a more advantageous asset. The goal is for the GRAT to increase in value greater than the allowable IRS interest rate at the time of funding (called the hurdle rate) while the grantor pays income tax on the GRAT’s taxable income as an additional tax-free gift to the beneficiaries. At the end of the GRAT term, the trust’s remaining assets pass to the designated beneficiaries. A GRAT can be funded with an asset such as S Corp stock, publicly traded stock, or hedge fund interest.

For December of 2020, the hurdle rate is 0.6%, one of the lowest in history. This presents an extraordinary opportunity to identify a depressed asset that has expected future growth. In the event the value of the GRAT fails to beat the hurdle rate, the grantor will merely get back everything they put in. If the grantor does not survive the GRAT term, the grantor’s estate will simply be in the same position as if the GRAT was not created.

If you are interested in learning more about Grantor Retained Annuity Trusts or other estate planning opportunities, contact your Anchin Relationship Partner or Tamir Dardashtian, Esq., Tax Principal in Anchin Private Client.