Articles & Alerts

How to Maximize Your Tax Strategy: The Interplay of the R&D Tax Credit, Employee Retention Credit and PPP Loans

While COVID-19 and its variants continue to complicate business and tax planning, Anchin continues to stay on top of the evolving landscape to better advise our clients. The Employee Retention Credit (ERC) is a refundable payroll tax credit available to businesses affected by COVID-19 that continued to pay salaries to their employees. It is available to taxpayers for the 2020 calendar year and the first three quarters of 2021. Meanwhile, with the Paycheck Protection Program (PPP) ending on May 31, 2021, many businesses still remain eligible for PPP loan forgiveness.

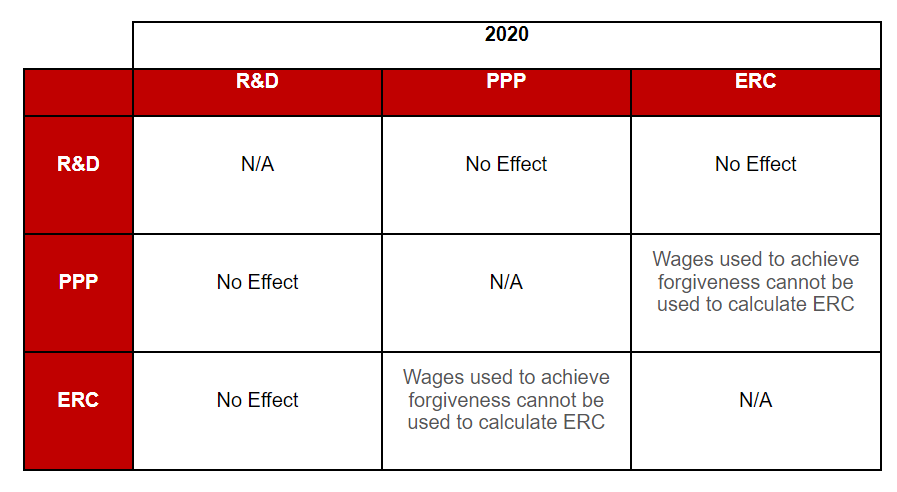

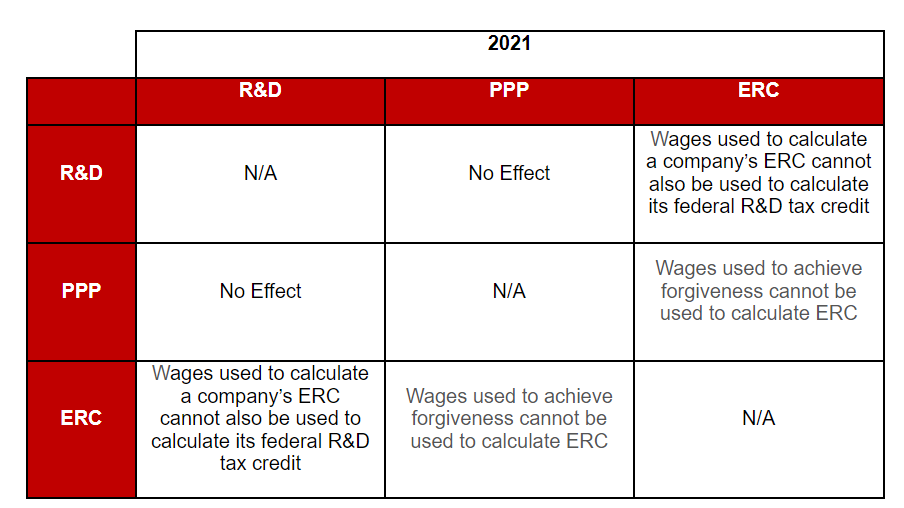

When strategizing how to best take advantage of these programs, there are some important considerations about how they impact one another. For example, wages deemed eligible for the ERC are not also eligible for 2021 R&D tax credits. PPP loans will not affect R&D tax credits, but wages reimbursed by forgiven loans, not in excess of the loan amount, are not also eligible for ERC. The tables below summarize the interaction among the R&D tax credit, ERC and PPP for both 2020 and 2021 and how claiming one may impact the calculation of another.

Even if your company has received significant ERC benefits in 2020 and 2021, Anchin’s R&D tax credits team can work with you to properly claim the R&D tax credits to which you are also entitled. It is important to keep in mind that any reduction in 2021 R&D tax credit claimed, as a result of concurrent ERCs, likely will benefit your company’s R&D tax credits for the next few years.

Anchin’s R&D tax credit consultants are well-positioned to help you formulate the optimal solution for your company to maximize your benefits under the R&D, PPP and ERC credit programs. If you have any questions about how the interplay of these programs impacts you, please reach out to Yair Holtzman, Tax Partner and Anchin’s R&D Tax Credits Leader, or your Anchin Relationship Partner.