Articles & Alerts

Key Tax Provisions in the BBBA for International Companies

On Friday, November 19th, the United States House of Representatives passed the Build Back Better Act (BBBA). This legislation contains many provisions that will affect companies of all sizes, including multi-national corporations (MNCs). Some key areas of interest for MNCs include the new corporate minimum tax rate as well as changes to the calculation, rate and Qualified Business Asset (QBAI) of the Global Intangible Low-Tax Income (GILTI), the Foreign Derived Intangible Income (FDII) deduction and the Base Erosion and Anti-Abuse Tax (BEAT).

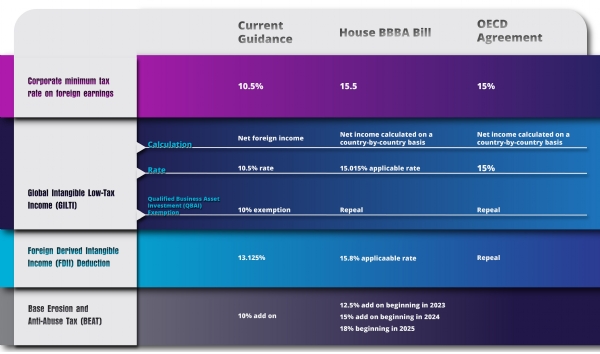

In this article, we will take a closer look at the proposed changes to these provisions (summarized in the chart below), the impetus behind them, and how they might affect small- and medium-sized MNCs.

This past October at the OECD, nearly 140 countries agreed to the most sweeping overhaul of global tax rules in a century. The accord aims to curtail instances of companies using low-tax jurisdictions to reduce their overall tax liability by applying a global 15% minimum corporate tax rate among all companies. If passed, the legislation is projected to lead to as much as $150 billion in additional tax revenue annually.

Signatories, including the U.S., are targeting 2023 for the implementation of these new economic goals, but many experts say that this is an ambitious goal. Many of the proposals contained in the BBBA are aimed at bringing the U.S. into compliance with this new accord.

Global minimum corporate tax rate

Currently, the U.S. implements a corporate minimum tax rate of 10.5% on foreign earnings; however, many large companies are able to reduce this tax liability to as low as around 4% by exploiting low-tax jurisdictions. The BBBA proposes to halt such tax avoidance by charging U.S.-based MNCs that reported an average $1 billion or more in profits to shareholders over the past 3 years a separate 15% minimum tax per country on their foreign earnings. Last year this would have included about 241 companies, 30% of which paid less than 15% globally. This proposal is in accordance with the OECD global tax agreement.

In the case of corporations with foreign parents, the provision only applies when the foreign parent has adjusted financial statement income in excess of $100 million.

Changes to GILTI

The Tax Cuts and Jobs Act (TCJA) of 2017 established GILTI as a category of income that is earned abroad by U.S.-controlled foreign corporations (CFCs) – essentially, controlled subsidiaries of U.S. corporations – from easily movable intangible assets (such as intellectual property), in order to discourage companies from moving these assets to low-tax jurisdictions. The TCJA established the taxable rate for GILTI at 10.5%. For tax years after 2022, the BBBA would increase the GILTI tax rate to 15.015% and reduce the applicable percentage of eligible income from 50% to 28.5%. While the listed rate is 15.015%, many claim that other changes to GILTI raises the tax rate to as much as 28%.

The means by which a corporation calculates its GILTI will also be modified to account for a country-by-country calculation basis rather than net foreign income, which is required by the OECD agreement. Performing the calculations in this manner prevents companies from shielding income earned in low-tax jurisdictions with foreign taxes paid on income earned in higher-tax jurisdictions.

Lastly, the BBBA also proposes the repeal of the QBAI Exemption, which allows U.S.-based MNCs the ability to earn tax-free income by putting tangible assets such as factories, machinery and buildings overseas, as this exemption is believed to incentivize offshoring.

Changes to the FDII deduction

The FDII is an incentive for U.S. C-corporations to generate revenue from serving foreign markets by applying a preferential tax rate (13.125%) to eligible income in the hopes of encouraging companies to keep their intellectual property in the U.S. This deduction was determined by the OECD to be a harmful tax practice, and therefore needs to be repealed in order to remain in compliance with the accord.

However, in its current form, the BBBA raises the rate to 15.8% and reduces the applicable percent of income from 37.5% to 24.8% for tax years after 2022.

Changes to BEAT

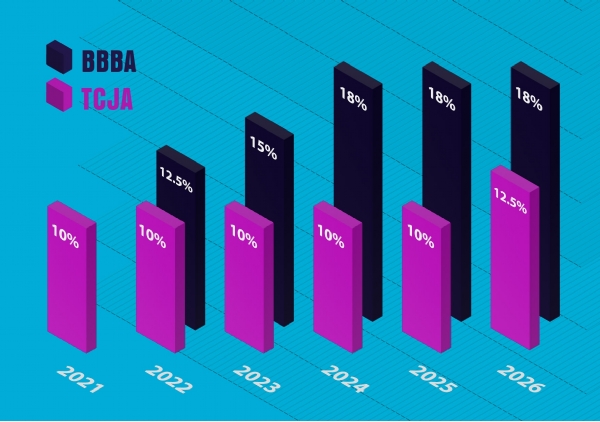

Currently, the BEAT requires MNCs reporting average gross receipts exceeding $500 million to be subject to a minimum tax add-on of 10%. The BBBA would incrementally increase the BEAT.

The BEAT also allows for a de minimis exception of up to 3% of a corporation’s total deductions to be made to foreign affiliates before the BEAT applies. The BBBA would eliminate this exception beginning in tax years after 2024.

Takeaways and next steps

The bill will now face a vote in the Senate, and will likely be approved by President Biden if passed in the Senate. While many of the above tax provisions are more targeted at large companies, and even though the future of this Act remains unclear, companies of all sizes should assess their preparedness for the passing of the BBBA. In order to assess your company’s preparedness, ask yourself…

- Where are your international holdings located?

- Will this proposed legislation result in significant changes to the tax legislation in those countries?

Now is the time to have a discussion with your international team to ensure that you are ready for these changes if they are passed. If headline corporate rates remain consistent, which seems likely, small- and medium-sized businesses will have opportunities for deferral planning and even permanent savings in certain service industries with foreign operations. Additionally, corporate holding companies may still yield a small tax rate benefit for offshore income. Lastly, for entrepreneurs who may have some flexibility in where they work, relocating operations to Puerto Rico can yield significant savings; please review this article for more information about this opportunity.

If you have any questions about how these or other proposed provisions of the BBBA might affect your business, contact Gwayne Lai, Director of Anchin’s International Taxation group, or your Anchin Relationship Partner.