Articles & Alerts

The Tax Impacts of Debt & Restoration of Debt

As Seen in Real Estate NJ

Leverage is an important instrument for real estate owners and investors. Utilizing leverage appropriately can help enhance returns, build a diversified portfolio, strategically enter the market, and provide tax benefits. As the capital markets have become increasingly challenging, many lenders are requiring guarantees by the mortgagors. The use of a guarantee can drive surprising tax results. This article will concentrate on how mortgage debt affects the tax basis of acquired property, as well as the investment basis of real estate owners and investors in partnerships (note that real property held in different types of entities may yield varied outcomes).

Learn More Real Estate Tax Compliance

Generally, mortgage debt is included in a property’s tax basis when acquired. For example, partnership PRS is formed by A and B to acquire Property C for $1,000 with $750 of the purchase price of Property C allocated to the building and $250 allocated to land. A and B each contribute $100 of capital to PRS. Subsequently, PRS takes out a loan, on a nonrecourse basis, for $800 to fund the balance of the purchase. The tax basis in the property will be the full $1,000 purchase price. In this case, partners A and B will be able to enjoy depreciation deductions on $750 of depreciable basis even though they only made an aggregate capital investment of $200. One important item to note is that any increases in the debt from later refinancing will not increase the tax basis of the property unless the proceeds are used for capitalizable expenditures.

Outside of establishing basis in depreciable property, mortgage debt may be included in the basis of the owners and investors (this does not apply to real property held in corporations). Generally, recourse and nonrecourse debt that is secured by a property used in a real property trade or business will give basis in the investment enabling the owner or investor to take distributions or deduct depreciation in excess of the amount contributed to the investment. Using the facts from the example above, both partner A and B have a basis in their partnership interest of $500 – $100 of equity contribution plus $400 for their respective share of debt (this assumes pro-rata allocation of nonrecourse debt; special allocations of nonrecourse debt are beyond on the scope of this article). This basis enables a partner to take $500 of distributions from the entity tax free or deduct up to $500 of losses (or any combination of the two) despite only a $100 investment.

If property is mortgaged on a recourse basis, the debt basis is allocated to the partner(s) who guarantees the debt since they are deemed to shoulder the economic burden. It is possible for a debt to be part recourse and part nonrecourse if there is a limited guarantee; however, bottom dollar guarantees are not treated as recourse debt for tax purposes. If property is financed entirely with nonrecourse financing, the debt is generally allocated to each partner based on their percentage ownership in the partnership.

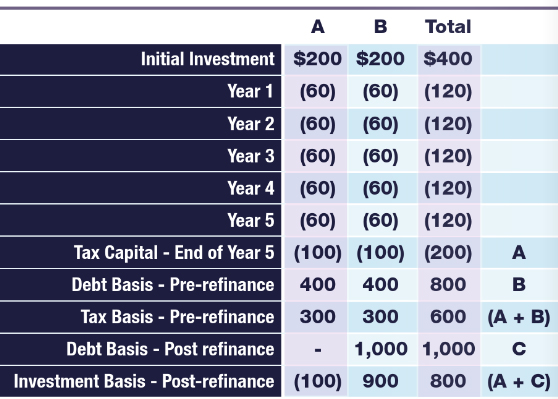

Refinancing a property can lead to surprising tax consequences if there is a change in the recourse nature of the debt, or if new or different parties are guaranteeing the debt. Using the example above, assume revenues equaled expenditures for years 1-5 and there was an additional $120 of annual depreciation. Furthermore, at the beginning of year 6, the debt was refinanced for $1,000 and was fully guaranteed by partner B. Lastly, a deficit restoration obligation does not exist in the partnership agreement. How is each partner impacted? Partner B will see an increase in her tax basis of this investment in PRS. She will be able to deduct all depreciation allocated to her and any distributions can be made tax free to the extent of her investment basis. Partner A has a less desirable outcome. She will be able to deduct all depreciation in years 1-5 since she is deemed to have sufficient basis. However, when the entity refinances, she will have a taxable event to the extent of her deficit capital account ($100) since the debt basis was shifted away from her. In addition, any distributions will be taxable as capital gains until partner A’s capital account is restored through either income allocations or additional capital contributions. This example is illustrated below:

While economics drive transactions, tax implications can have a meaningful impact. In today’s challenging lending environment, it is important to evaluate all aspects of a debt transaction. While guarantees may be necessary to obtain debt, understanding how it impacts the owners as well as the property is crucial. Taxable debt shifts, especially those that aren’t coupled with distributions from a refinance, can result in unhappy partners. They may also lead to requests for tax distributions which could put a strain on cashflow. Accordingly, it is imperative to discuss the potential tax impacts with advisors before finalizing any new loans.