News & Press

The Fed Just Cut Interest Rates. What Does It Mean for Architects?

As featured in Archinect:

In September 2024, the U.S. Federal Reserve cut the target range of interest rates for the first time in four years.

The move was long anticipated by AEC commentators, who hoped that the lower cost of borrowing would begin to pull the sector out of a two-year stagnation in business conditions.

We explore what the interest rate cut means in the context of 2024’s architectural business conditions with input from Phillip Ross, partner at the AEC division of financial firm Anchin.

A sluggish end to 2024, for most

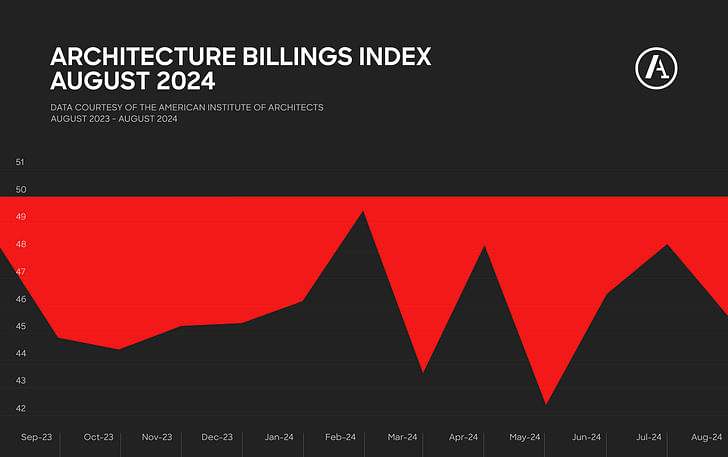

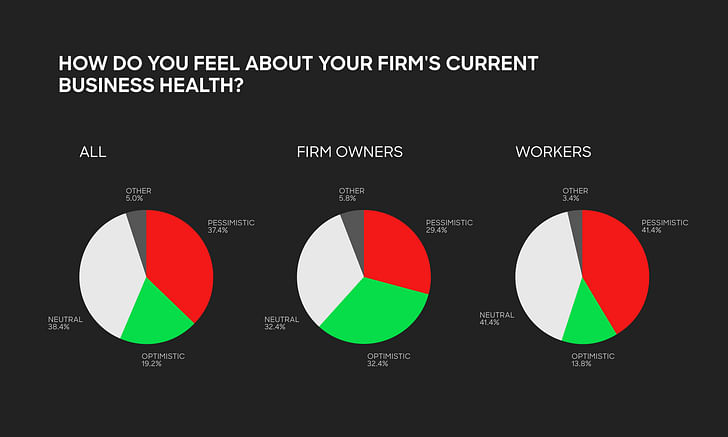

As we enter the final quarter of 2024, architectural business conditions remain turbulent. AIA data shows that billings from architecture firms have been in decline for almost two years, while our recent Archinect Business Survey found that architects and clients are largely downbeat about the business health of their firm, industry, and the wider U.S. economy.

“It’s a tough economic landscape in general,” Phillip Ross told me recently. A partner at New York financial firm Anchin, Ross co-leads the company’s architecture, engineering, and construction division. “You have companies out there who are doing well, companies that are not, and some in the middle. There isn’t a consensus.”

Indeed, it is worth remembering that although 37% of our survey respondents were pessimistic about their firm’s business health, 19% were optimistic, and 38% were neutral. In our conversation, Ross points to data centers as a typology performing well in the AEC industry, backed up by Dodge Construction Network’s assessment last month that data centers were having an outsized positive influence on nonresidential planning activity. Ross also points to better performance among public sector projects, aligning with Dodge’s findings that institutional planning and construction are rising.

Data from Archinect’s 2024 Business Survey

For the many architects whose business derives from private residential and commercial work, however, the high-interest rate environment continues to bite.

“There’s been a lot of prominent developers who have stopped projects,” Ross told me. “To them, it’s not worth financing a project at high interest rates. There have even been some developers who have given a project back to the bank, and that’s almost unprecedented.”

There have even been some developers who have given a project back to the bank, and that’s almost unprecedented. — Phillip Ross, Anchin

“With interest rates being higher, you’ve had fewer starts on new projects because it wasn’t worth it, and if a client already owns the land, they were comfortable sitting on it,” Ross added. “Real estate values are also going down, which is another disincentive to continue building. All of these factors have worked against the industry.”

“Even if you have projects, it is taking longer to finalize the project, get bids out, evaluate bids, award the work, and start building. So even if someone has a good backlog, they are not sure when some of that will generate billing. So, it’s tough for the industry in general.”

Not your regular downturn

Stepping back, there is no single explanation for the industry’s current business landscape. Rather, our analysis of the Archinect Business Survey identified five overarching forces working in tandem to suppress architectural business: interest rates, construction costs, wider inflation, post-pandemic trends, and what we dubbed a “perfect storm of instability and uncertainty.”

Our industry is no stranger to downturns. Back in August 2022, I spoke in detail with AIA Chief Economist Kermit Baker on how architectural business fared during and after the pandemic. In that conversation, Baker underlined how construction was “an extremely cyclical sector” where a 10% increase or decrease in construction spending can have dramatic impacts on architectural business.

During COVID, the AIA’s Architecture Billings Index showed less than one year of contraction in billings before the profession entered positive territory again in February 2021.

If we’ve been here before, can’t we simply look to past downturns as roadmaps for how, and when, the industry will recover now? Not so simple, says Ross.

“It’s tough to compare this to COVID,” Ross told me. “Back then, some companies were doing very well because of special work, and you also had a high level of government assistance through PPP loans and ERC credits. Even if a firm wasn’t doing well, government assistance definitely helped to offset the losses.”

The economic downturn experienced during 2020 was, as AIA’s Baker told me at the time, “sudden, severe, but for more sectors, short-lived.” During COVID, the AIA’s Architecture Billings Index showed less than one year of contraction in billings before the profession entered positive territory again in February 2021. From then on, the index would remain in positive territory for almost two years. Today, by contrast, the index has sat in negative territory for almost two years.

By Archinect using data provided by the American Institute of Architects

The interest rate environment is also considerably different from during the COVID downturn. After almost a decade at near-zero levels, interest rates began steadily increasing in 2016, peaking at approximately 2.5% in late 2018. As the pandemic hit, rates immediately dropped to near-zero again, where they sat until the beginning of 2022. Since March 2022, however, rates have climbed to sit at levels not seen since 2007, surpassing 5% in mid-2023.

“We’re coming off of a high interest rate environment that has existed for a long time,” Ross noted. “High interest rate environments happen from time to time, but this has been extended, which has contributed to the industry environment today.”

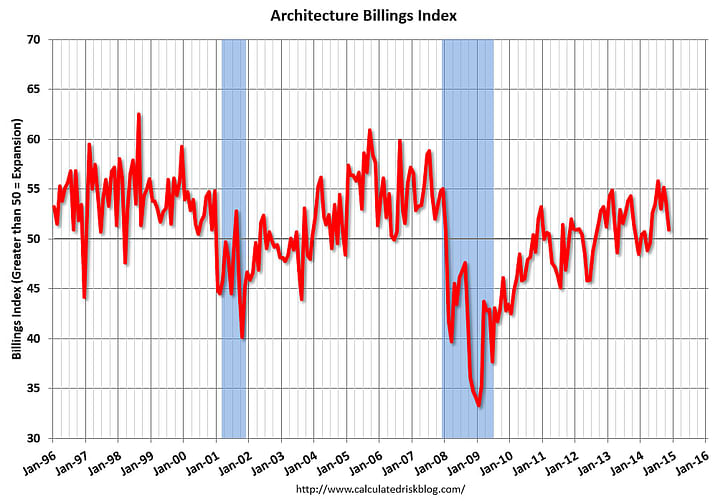

Coincidentally, the Fed’s interest rate today sits at almost exactly the same level as it was in 2007, before a series of rapid cuts in response to the 2008 economic crash. Back then, the AIA’s Architecture Billings Index began a decline in January 2008 that lasted every month for two and a half years until July 2010. Sustained growth only returned to the industry midway through 2012.

AIA Architecture Billings Index data 1996-2016

This doesn’t make 2008 the perfect blueprint for understanding how and when the architecture industry will see a recovery from today’s conditions. The 2008 recession was set in motion largely by a collapse in the real estate market; an intrinsic flaw in U.S. economic practices with the architectural profession near its epicenter. However, the turbulent AEC environment of the past two years has manifested without any similar collapse. In fact, median house prices in the U.S. currently sit at a record high.

In our conversation, Ross also points out how today’s downturn comes against the backdrop of a different employment landscape to that of the period 2008 to 2010.

It’s not as if people aren’t working; employment numbers are high right now. — Phillip Ross, Anchin

“During a downturn, you’re typically also looking at high unemployment,” Ross told me. “But right now, we are dealing with high employment. It’s not as if people aren’t working; employment numbers are high right now.” For context, the U.S. unemployment rate after the 2008 crash peaked at 10% in October 2009, while today, the figure stands at 4.3%.

“Typically, when looking at a potential downturn, all of these factors are there,” Ross summarized. “Here, you don’t have that. It makes financial planning, monitoring, and budgeting much more important because we are dealing with a landscape different from that we would deal with in other downturns.”

So, interest rates were cut. What now?

While interest rates form only one piece in our economic jigsaw, commentators across the AEC sector have nonetheless expressed hope that a move by the U.S. Federal Reserve to cut the target range of interest rates would spur design and construction activity. This isn’t without reason. As our aforementioned piece from 2022 noted, the Fed’s decision to slash interest rates in March 2020 to essentially zero percent served, as it historically does, as a short-term catalyst for new construction activity.

“Interest rates were virtually zero, so if you were a client, there was never a better time to build,” Fogarty Finger founder and director Chris Fogarty told me in 2022, recalling his firm’s experience of 2020. “Bit by bit, our clients emerged with new commissions, particularly in multifamily projects. By September 2020, our resurgence was underway.”

Commentators hoping that a similar revival would begin in late 2024 were greeted with promising news last week when Federal Reserve chairman Jerome Powell announced a 0.5% cut in the Fed’s target range of interest rates; the first interest rate cut in four years, and more than the 0.25% cut widely predicted by analysts. The Fed has also penciled in several more rate cuts for 2024 and 2025, while CBS News reports that the rate cut is already trickling down into lower rates on some lending products.

In a recent conversation on the eve of the Fed’s announcement, I asked former HOK chairman and CEO Patrick MacLeamy whether such cuts do indeed boost the demand for architectural services. “Yes, it does have an impact,” MacLeamy told me. “However, it is not instantaneous. It will take months to ripple through the economy. For a client to decide that they can now borrow money more cheaply and build the building they want, it is going to take six months [from the Fed’s announcement]. Don’t count on it as an instant turnaround; it’s too macroeconomic.”

For Anchin’s Phillip Ross, meanwhile, the impact of the rate cuts for architects will be gradual, rather than instantaneous. “You’ll hear a buzz from contacts or industry organizations,” Ross explains. “You might hear that ‘Developer A’ will start new projects after another half-point cut, while ‘Developer B’ is waiting for rates to fall even lower.”

Here, it is important to distinguish between the nature of interest rate cuts today versus during the COVID downturn. In 2020, the Fed’s interest rate cuts were sudden and severe, arguably hastening the impact of such cuts on design and construction. In 2024, however, interest rate cuts are likely to be more moderate, and their impact on the industry more gradual.

Even with lower interest rates making construction loans more attractive, architects and their clients must still contend with a series of present challenges.

As noted earlier, interest rates are only one piece of the economic puzzle. Even with lower interest rates making construction loans more attractive, architects and their clients must still contend with a series of present challenges. As readers previously told us via our business survey, these include ongoing material and labor supply issues in the construction industry, a new landscape for office and workplace design, and the unpredictability that comes with an election year, the results of which could dictate federal spending across a range of construction typologies, most notably residential, manufacturing, and infrastructure.

This month alone, for instance, Democratic presidential candidate Kamala Harris announced plans to build three million more homes over four years, while Republican candidate Donald Trump announced plans to allow federal land in Nevada to be zoned for large-scale housing construction.

“There are still a lot of questions that will be clarified more as we move across November and December,” Ross told me. Referencing the impact of the upcoming presidential election, Ross notes that “in the past, even when there were great programs planned, you have to wait for the program to launch and wait for the spending to become available. It doesn’t happen overnight, but we will soon get an idea as to when that would potentially happen.”

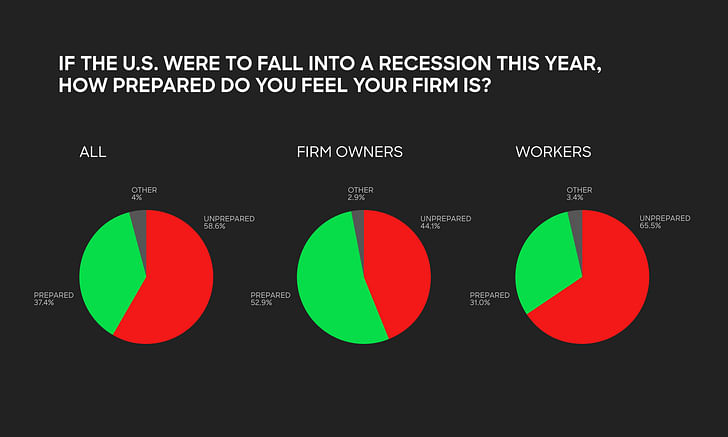

Data from Archinect’s 2024 Business Survey

Riding out the storm

This is not to say that the decline in interest rates will have no impact on the industry; history and analysis show us that they do. However, architects will still be required to contend with a turbulent business landscape in the intervening months before the impact of rate cuts is felt. For Ross, there are several strategies that architects can adopt to build resilience in the face of downturns, present and future.

“Look at diversifying,” Ross advises. “Firms can get comfortable staying in their niche. But typically they will have expertise that allows them to be able to do other things too. Diversify and see if you can reinvent parts of yourself.” To help this, Ross advises that firms take advantage of as much economic information and analysis as possible, building an understanding of what services, typologies, or building technologies are in demand.

Make sure your client relationships are as good as possible so that when those clients do have work, they are going to call you. — Phillip Ross, Anchin

“If you are worried about profitability, take a look at your costs and develop good budgets,” Ross adds. “Many firms develop budgets, but you also have to monitor them. A budget is only good if you really use it. Yes, you can stray from it, but it has to be for good reasons.” While acknowledging that a budget will never be one hundred percent exact, Ross notes that this strategy allows architects to predict potential issues months ahead.

“If in six months you see there could be an issue, you have six months to figure out how to get over that issue,” Ross explains. “You have six months to spot financial or cashflow issues, and to make sure that you have bank financing in place.”

Finally, Ross emphasizes the importance of people as well as projects. In addition to shoring up client relationships, Ross notes that downturns can be an opportunity to take staff hours normally devoted to projects and repurpose them for training and skill development.

“Make sure your client relationships are as good as possible so that when those clients do have work, they are going to call you,” Ross explains. “This could also be a time to train and develop your staff so that when you do get the work, they can be more efficient. Perhaps they will be better at identifying solutions, but also better at showing what makes your firm different.”